Predicting the Impact from Future HELOC Loan Resets Time to Refinance?

by MPA | Nov 26, 2014

The majority of home equity lines of credit (HELOC) were originated at the peak of the home equity boom between 2004 and 2006, so the concern now is the oncoming wave of defaults when the estimated $190 billion in HELOC loans reset between the fourth quarter and 2017.

The fear is that payment shock will not only cause a wave of defaults, but that it also may impact bank balance sheets and the mortgage markets where HELOCs are concentrated. Unlike the first-lien market when banks sold off most of the credit risk, more than 85% or $580 billion worth of HELOC loans are on bank balance sheets, and nearly 50% of them are located in California, Florida, and New York. So, should the market brace itself for the big storm of the reset, or are the fears unfounded?

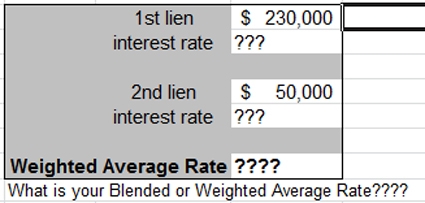

Should you have a HELOC that was originated in 2004 – 2007 the time is now to Refinance by going to the David Haley Mortgage website and applying now! If you need more info on David Haley, check out his Testimonials or try out his Mortgage Calculator. With home values on the rise, it is time to take advantage of the current market trend! Call David Haley today to see what your true Blended Mortgage Rate is.

The surge in mortgage debt during the mid-2000s was partly fueled by an increase in HELOC loans as borrowers took advantage of the rapid run-up in home prices to extract equity. Borrowers tapped home equity to supplement their incomes and provide an additional source of liquidity. Part of the reason for the soaring popularity of HELOCs was that, unlike the first-lien mortgage market, which is composed primarily of fully amortizing loans, HELOC loans were typically originated as 10-year, interest-only loans. These loans switch to fully amortizing loans after a decade. At the end of the interest-only period, borrowers would experience a payment shock as they then had to pay back both interest and principal.